All Categories

Featured

Table of Contents

Inherited annuities come with a death advantage, which can offer economic security for your enjoyed ones in the occasion of your death. If you are the beneficiary of an annuity, there are a few regulations you will require to follow to inherit the account.

Third, you will certainly require to provide the insurance provider with various other called for documents, such as a duplicate of the will or count on. 4th, depending on the kind of acquired annuity and your personal tax obligation situation, you might need to pay tax obligations. When you inherit an annuity, you must choose a payment option.

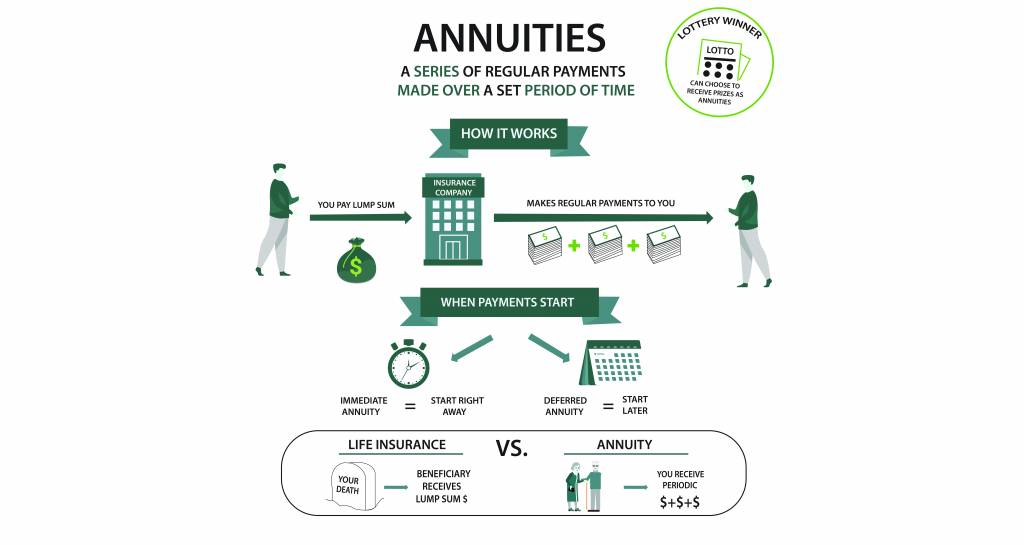

With an immediate payout choice, you will certainly start receiving payments today. The repayments will certainly be smaller than they would be with a postponed choice since they will be based on the existing worth of the annuity. With a deferred payment option, you will certainly not start obtaining settlements later on.

When you acquire an annuity, the taxes of the account will depend upon the sort of annuity and the payment alternative you choose. If you inherit a traditional annuity, the settlements you obtain will certainly be exhausted as regular revenue. If you inherit a Roth annuity, the payments you receive will not be taxed.

Annuity Payouts inheritance and taxes explained

If you choose a deferred payout alternative, you will not be exhausted on the growth of the annuity up until you start taking withdrawals. Talking to a tax obligation advisor prior to acquiring an annuity is necessary to ensure you understand the tax obligation implications. An inherited annuity can be a wonderful means to offer financial safety for your loved ones.

You will certainly additionally need to adhere to the policies for acquiring an annuity and pick the best payment choice to match your requirements. Finally, make sure to speak to a tax expert to ensure you understand the tax obligation effects of inheriting an annuity. An inherited annuity is an annuity that is given to a beneficiary upon the fatality of the annuitant

To acquire an annuity, you will require to provide the insurance provider with a duplicate of the death certificate for the annuitant and complete a recipient kind. You may need to pay tax obligations relying on the sort of acquired annuity and your personal tax obligation scenario. There are two main sorts of inherited annuities: typical and Roth.

If you acquire a conventional annuity, the settlements you receive will be tired as normal revenue. If you acquire a Roth annuity, the repayments you receive will not be strained.

Is an inherited Multi-year Guaranteed Annuities taxable

Exactly how an inherited annuity is taxed relies on a variety of factors, however one key is whether the cash that's appearing of the annuity has been taxed before (unless it's in a Roth account). If the cash dispersed from an annuity has not been exhausted in the past, it will undergo tax obligation.

A qualified annuity is one where the proprietor paid no tax on payments, and it may be kept in a tax-advantaged account such as conventional 401(k), typical 403(b) or standard individual retirement account. Each of these accounts is moneyed with pre-tax cash, indicating that tax obligations have actually not been paid on it. Given that these accounts are pre-tax accounts and earnings tax obligation has actually not been paid on any of the cash neither contributions neither incomes distributions will certainly undergo average income tax.

A nonqualified annuity is one that's been bought with after-tax cash, and distributions of any type of payment are not subject to income tax obligation since tax obligation has actually already been paid on payments. Nonqualified annuities consist of two significant kinds, with the tax obligation treatment relying on the type: This type of annuity is bought with after-tax money in a regular account.

This type of annuity is purchased in a Roth 401(k), Roth 403(b) or Roth individual retirement account, which are all after-tax retired life accounts. Any typical circulation from these accounts is without tax on both contributed money and profits. At the end of the year the annuity company will certainly submit a Type 1099-R that reveals exactly how much, if any, of that tax obligation year's distribution is taxed.

Beyond revenue tax obligations, a successor might also require to determine estate and estate tax. Whether an annuity goes through revenue taxes is an entirely separate matter from whether the estate owes estate tax on its value or whether the heir owes estate tax on an annuity. Estate tax obligation is a tax obligation evaluated on the estate itself.

Private states might also levy an estate tax obligation on cash distributed from an estate. They're not assessed on the estate itself however on the successor when the possessions are gotten.

Taxes on inherited Annuity Income payouts

government does not evaluate inheritance tax obligations, though six states do. Rates range as high as 18 percent, though whether the inheritance is taxed depends on its dimension and your relationship to the giver. So those inheriting big annuities should focus on whether they're subject to estate taxes and inheritance taxes, beyond simply the typical revenue taxes.

Successors need to take note of possible inheritance and inheritance tax, as well.

It's a contract where the annuitant pays a swelling amount or a series of costs in exchange for a surefire earnings stream in the future. What occurs to an annuity after the proprietor passes away hinges on the certain information laid out in the contract.

Various other annuities offer a death benefit. The payment can take the type of either the whole continuing to be balance in the annuity or an assured minimum amount, generally whichever is greater.

It will plainly recognize the recipient and potentially lay out the readily available payment options for the fatality benefit. An annuity's death benefit ensures a payout to a designated beneficiary after the owner passes away.

Table of Contents

Latest Posts

Exploring Fixed Vs Variable Annuities A Comprehensive Guide to Investment Choices What Is the Best Retirement Option? Pros and Cons of Various Financial Options Why Fixed Indexed Annuity Vs Market-var

Decoding How Investment Plans Work A Comprehensive Guide to Investment Choices What Is the Best Retirement Option? Advantages and Disadvantages of Different Retirement Plans Why Variable Annuities Vs

Decoding Fixed Index Annuity Vs Variable Annuities Key Insights on Annuities Variable Vs Fixed Breaking Down the Basics of Pros And Cons Of Fixed Annuity And Variable Annuity Benefits of Choosing the

More

Latest Posts